Understanding Deals to have Change CFDs: Uses and you can Instances

CFD trading comes to high-risk and you can leveraged ranks inside the economic locations, requiring experience, study, and you may an insight into business moves. Although it offers risk and you can speculation services having gaming, CFD trading will be based upon monetary actions and you may field research, determining it from sheer playing, and that relies on opportunity. Yet not, without the right chance government, change can also be resemble playing in its possibility of losses. CFD change within the crypto lets traders to take a position to your rate moves of cryptocurrencies such Bitcoin or Ethereum. This process permits change for the margin, offering the potential for cash in both ascending and you may falling places instead of getting the actual cryptocurrency.

For individuals who promote plus the rate rises, then you definitely create a loss, and you will the other way around. A few of the trader 10 evista complaint encompassing CFD exchange are associated with the new CFD brokers’ unwillingness to inform their users regarding the mindset involved in this kind of large-exposure trading. Items such as the concern about shedding, one means neutral and also shedding positions,49 become a reality if the profiles move from a demonstration membership to the genuine one. When you’ve felt like and that field we would like to change, you’lso are ready to place a package.

Trader 10 evista: The place to start CFD Change?

The fresh investor expenditures one hundred offers of one’s SPY to have $250 for each share for a great $25,one hundred thousand reputation where simply 5% otherwise $step one,250 is paid off very first to your representative. Those who comprehend the contrary downwards path will actually sell a gap status. Not owning the underlying investment is also allow buyers to help you apply certain fascinating features provides.

- From the understanding these types of differences, people is greatest determine which strategy aligns using their economic desires and you may chance endurance.

- Agents render control to help you traders which help fund the brand new latter’s investments.

- The strategy you utilize relies on the root advantage and you can industry requirements.

- So you can calculate extent, a trader multiplies how many CFD products purchased because of the count the fresh show speed rose in the value ($ten x ten CFDs).

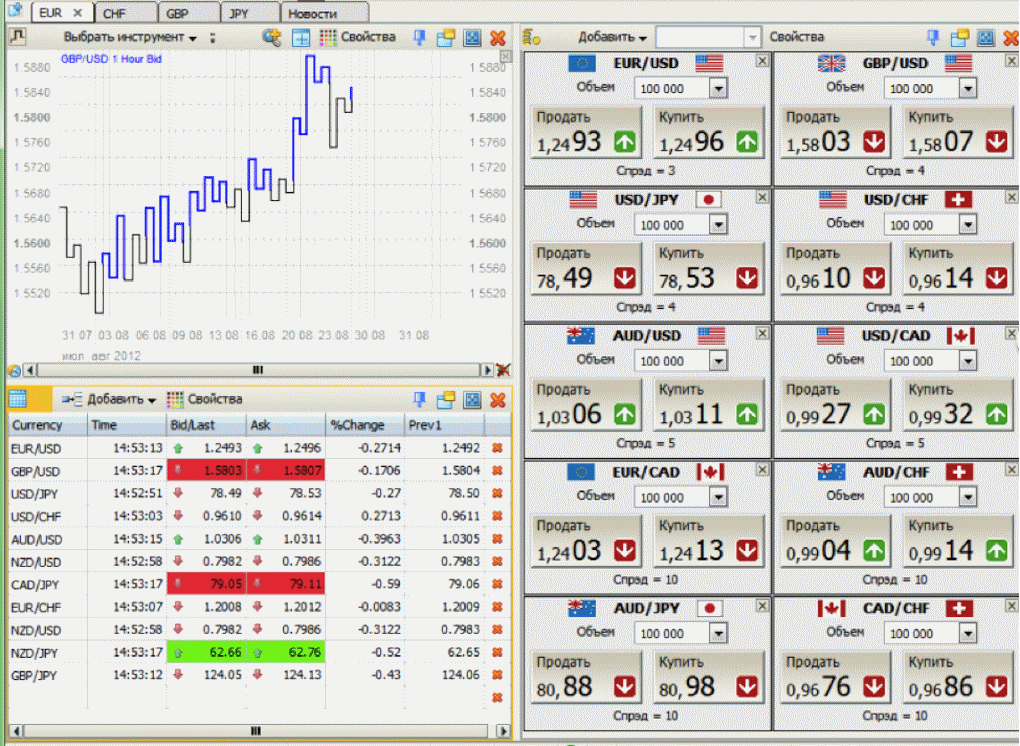

It’s a simple tool from dimension accustomed track changes in the price of a secured asset, especially in currency trading. In this guide, we’ll render straightforward reasons and you can standard ideas to assist newbies learn the basics of Contracts for Variations (CFDs) change. If or not you’lso are only undertaking otherwise trying to improve the trading experience, all of our point is to let give you the crucial degree required so you can change CFDs effortlessly. The newest bequeath ‘s the difference between both of these prices, inside our example is actually $10. That it number will help you to see a managed representative that provides a top-quality program, great customer support, useful search and cost-active prices.

The price drops so you can $160, giving you a profit of $1,100000, or $10 for each display. In the event the, but not, the purchase price increases so you can $180 a portion, your lose $1,100000, or $ten a share. Which standardized means ensures CFD exchange closely aligns which have antique industry trading however with the added freedom of power no ownership of one’s hidden advantage. Whenever trading CFDs, it’s vital that you know how give and percentage performs, because they are the main can cost you out of exchange. Because of the knowledge this type of distinctions, buyers is greatest figure out which approach aligns using their financial desires and you will chance endurance.

To handle the risk of speed jumps, traders would be to to change its condition proportions consequently and steer clear of overleveraging. Through the elimination of condition size, buyers can also be reduce impact out of sudden field moves on the account balance and reduce the possibility of tall losings. As well as, using end-losses orders may help stop rates actions and fall off overall losses. To conclude, CFDs or Contracts to own Differences render an adaptable opportinity for on the internet traders to operate within the a variety of monetary places instead of having the underlying possessions. Common in several countries, yet blocked on the U.S., CFDs present one another positives and negatives to help you buyers. CFDs have fun with power, definition people which have losing ranks you’ll face broker margin phone calls.

Do you know the best CFD brokers for beginners?

The brand new capabilities of CFDs does need to be experienced when it comes of exposure management. You could potentially consider starting restriction requests in order to automatically close a condition at the confirmed money level. Take-money orders slow down the probability of you waiting on hold in order to a good profitable trading for too long and you can viewing the purchase price slide again. Which often means answering certain questions to exhibit that you understand the dangers out of trade on the margin.

It provides a danger-totally free environment to explore the working platform’s has, routine trading, and you will sample procedures. Information develops is essential to possess investments because individually has an effect on profits. Narrower spreads eliminate trade costs and invite investors to go into and exit positions more effectively, when you’re greater spreads erode payouts. The fresh give ‘s the difference in an asset’s purchase (ask) speed and sell (bid) price. It’s the price of executing a trade and is short for the brand new agent’s cash.

But not, If you wish to keep everyday CFD exchange open just after the brand new slash-off-time (usually 10pm Uk date, however it can differ to have international locations), it will cost an instantly financing modifications. Inside fx, directory and you can commodities trading, Funding.com charge at once investment modifications for the complete exchange dimensions, while on stocks and you will ETFs costs is applied on the newest borrowed area. Investment.com have investors whom opportunities well worth over $1m an occasion, nevertheless the lowest deposit you could trading online that have is $20 (€20, £20, 100PLN). Part of the dangers of CFD trade is control, that will enhance losings, business volatility, and you will prospective account liquidation in the event the margin conditions are not met. Correct exposure management, such using prevent-losings requests and you will restricting control, can help remove risks. The capacity to trade long and short for the locations is probably one of the most enticing options that come with a CFD (Contracts to possess Distinction) trading platform.

Greatest CFD Exchange Agents

At the same time, the maintenance margin should be covered by equity, the account’s harmony filled with unrealised earnings and losings. The constant maintenance margin rises and you can down according to the prices out of possessions you’re change. Your bank account’s collateral should security the constant maintenance margin to store the new positions open, particularly in matter-of running loss.

Tips perform exposure that have CFD trading

The new pass on can vary according to business liquidity, volatility, as well as the broker’s prices design. Basically, more water and you may greatly traded possessions tend to have narrower develops, when you’re shorter quick assets may have large spreads. In the CFD trading, your order refers to an instruction given to a brokerage so you can execute a trade in your stead. Knowing the various types of requests and the ways to utilize them effortlessly is important to have doing positions considering your trading method and you can managing exposure. CFDs are very an excellent misinterpreted financial equipment considering the latest world situation. Similarly i have reputable brokerage firms taking CFD exchange during the high standards you’ll be able to.

Information CFD Trading: A comprehensive Scholar’s Book

Normally, the length of so it holding period vary depending on the particular conditions and terms of your own CFD contract. First, you ought to favor a secured item we should trade in and put up your status dimensions considering your own exposure threshold and you can change strategy. You will need to closely display screen your position or take step if needed, such modifying the positioning proportions otherwise leaving your change if you see a potential losses. Earlier overall performance is not any indication of future efficiency and you will taxation laws and regulations are at the mercy of changes.

Once you open and you will money a keen Forex and you may CFD account your becomes use of cost-free training sessions helping you to understand how to trade CFDs in our program. Places try vibrant and you will erratic and because actual money are involved, there’s a critical chance involved in the procedure. We should instead evaluate their feel and you will exchange records also since your understanding of these dangers.

The cost of your position hails from costs regarding the fundamental field. Exchange CFDs will be best for you if you’lso are looking for ways to change ascending otherwise shedding locations, and if we want to discover a position having fun with margin. Although not, CFD exchange try high-risk and also you can make a loss higher than the 1st put count.